Buying your first home can be an exciting and daunting experience, especially if you're facing high competition. With limited inventory and increasing home prices, it can be challenging to find the perfect home in today's real estate market. However, with expert mortgage tips, you can navigate the high competition and find your dream home.

1. Get Pre-approved for a Mortgage

Getting pre-approved for a mortgage is a crucial first step for first-time homebuyers. It helps you determine your budget and shows sellers that you're a serious buyer. To get pre-approved, you'll need to provide your financial information to a lender, who will then evaluate your credit score, income, and debt-to-income ratio.

2. Work with a Real Estate Agent

A real estate agent can be your greatest asset in a high competition market. They have access to the latest listings and can help you navigate the complex homebuying process. They can also provide valuable insights into the local market and help you negotiate the best deal.

3. Consider a Fixer-Upper

In a high competition market, it can be challenging to find a move-in ready home within your budget. Consider a fixer-upper as an option. A fixer-upper can be more affordable and give you the opportunity to personalize your home. Just be sure to budget for any necessary repairs or renovations.

4. Be Flexible with Your Offer

In a high competition market, you may need to be flexible with your offer to secure your dream home. Consider offering more than the asking price or including contingencies, such as waiving the inspection or appraisal. However, be sure to consult with your real estate agent and lender to ensure you're making a smart financial decision.

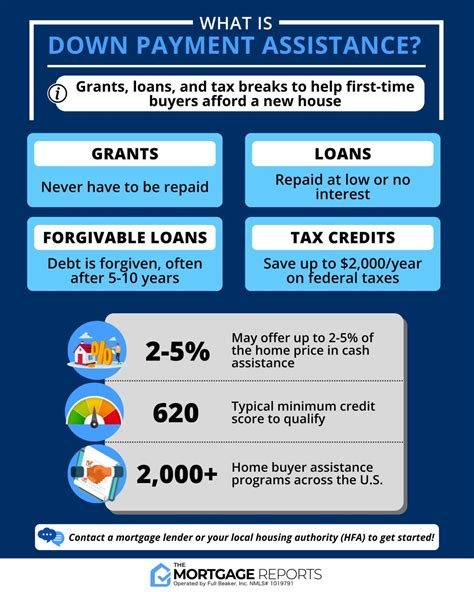

5. Research Down Payment Assistance Programs

For first-time homebuyers, the down payment can be a significant hurdle. However, many programs offer down payment assistance to qualified buyers. Research available programs in your area and work with your lender to determine if you're eligible.

6. Improve Your Credit Score

Your credit score plays a significant role in your ability to secure a mortgage and the interest rate you'll receive. Take steps to improve your credit score before applying for a mortgage, such as paying down debt, disputing errors on your credit report, and avoiding new credit inquiries.

7. Consider a Co-Signer

If you're struggling to qualify for a mortgage on your own, consider a co-signer. A co-signer is someone who agrees to take responsibility for the mortgage if you're unable to make payments. A co-signer can improve your chances of getting approved for a mortgage and may also help you qualify for a lower interest rate.

8. Shop Around for Mortgages

Don't settle for the first mortgage offer you receive. Shop around for mortgages to find the best interest rate and terms for your budget. Consider working with a mortgage broker, who can provide you with access to multiple lenders and help you compare offers.

9. Get a Home Inspection

A home inspection is an essential step in the homebuying process. It can help you identify any issues with the property before you make an offer and can also give you leverage in negotiations. Hire a professional home inspector to thoroughly examine the property and provide you with a detailed report.

10. Be Prepared for Closing Costs

Closing costs can add up quickly and may come as a surprise to first-time homebuyers. Be prepared for closing costs by budgeting for them in advance. Closing costs can include appraisal fees, title insurance, legal fees, and more.

11. Avoid Major Financial Changes

Before and during the homebuying process, it's essential to avoid any major financial changes. This includes changing jobs, taking out new loans, or making significant purchases. These changes can impact your credit score and debt-to-income ratio, which can affect your ability to secure a mortgage.

12. Have Realistic Expectations

Be realistic about what you can afford and what you're looking for in a home. Don't be discouraged if you can't find your dream home immediately or if you need to compromise on certain features. Remember that your first home may not be your forever home and that you can always make upgrades and improvements over time.

13. Keep Your Documents Organized

Throughout the homebuying process, you'll need to provide various documents to your lender and real estate agent. Keep these documents organized and easily accessible to avoid delays or complications. Documents may include tax returns, pay stubs, bank statements, and more.

14. Consider a Shorter Loan Term

Consider a shorter loan term when applying for a mortgage. While a longer loan term may offer lower monthly payments, a shorter loan term can save you thousands of dollars in interest over the life of the loan.

15. Don't Overspend on a Home

It's important to stick to your budget when buying a home. Don't overspend on a home just because you've been pre-approved for a higher amount. Consider all of your monthly expenses, including your mortgage payment, property taxes, and homeowner's insurance, when determining your budget.

16. Understand Your Mortgage Terms

Make sure you understand all of the terms of your mortgage, including the interest rate, payment schedule, and any fees associated with the loan. Ask your lender to explain any terms or concepts you don't understand before signing any documents.

17. Keep Your Credit Score in Check

Your credit score plays a significant role in your ability to qualify for a mortgage and your interest rate. Keep your credit score in check by paying your bills on time, avoiding new credit inquiries, and keeping your credit utilization low.

18. Be Prepared for a Bidding War

In a competitive housing market, you may find yourself in a bidding war for your dream home. Be prepared for a bidding war by understanding your budget and being ready to act quickly. Consider making a strong offer and including a personal letter to the seller to make your offer stand out.

19. Consider Alternative Homebuying Options

Consider alternative homebuying options, such as a rent-to-own agreement or purchasing a foreclosed property. These options may offer more flexibility and affordability for first-time homebuyers.

Conclusion

Buying your first home can be an overwhelming and exciting experience. With these expert mortgage tips, you can navigate the high competition in the housing market and find the perfect home for you and your budget.